During the property boom which preceded the recession many people began to dip their toes in the property market in the hope and expectation that increasing equity over a period of years would provide them with a reasonable or better return on their investments.

Buy a property at a reasonable price, let it out for a few years, sell it on and pocket the profits. Hence the boom extended to what became known as the ‘Buy to Let’ sector. The idea was simple enough. An individual or a couple with a reasonable disposable income purchase a property and let it out to tenants. Mortgages of up to 100% were easy to come by and rents were buoyant. In principle and often in practice the rental income more than covered the monthly mortgage payments. The property increased in value year by year and in due course the sale of the property would yield a nice little profit, even allowing for capital gains tax. And why stop at one property? If the idea worked with one property, why not go for two, six, twenty, a hundred or more properties?

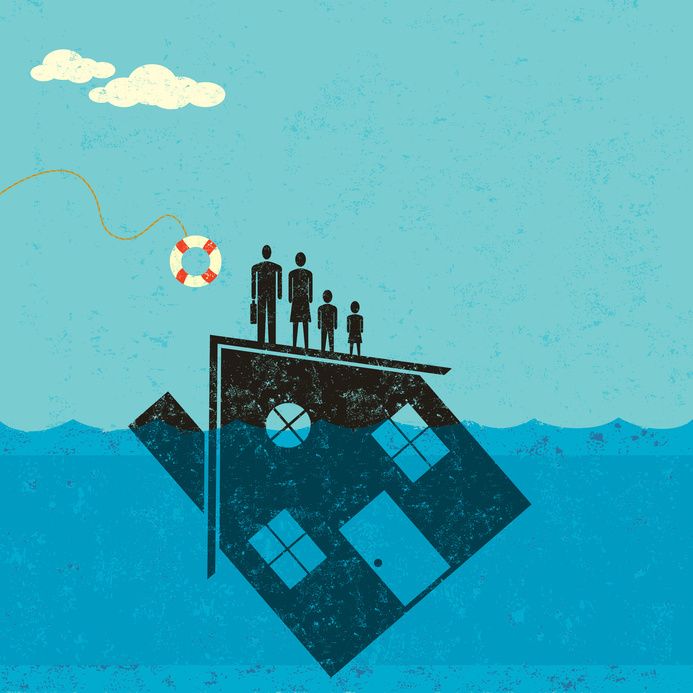

What could go wrong? Two things could and did. The continuous increase in property values slowed down and eventually began to go the other way as property sales volumes and prices tumbled. The demand for rental properties began to reduce and rental income began to fall. Suddenly those who entered the ‘Buy to Let’ sector found that they were unable to reverse the process easily. As demand for property fell so did prices. And so did rental incomes. The mortgage payments on some properties began to exceed the rental income and in some cases it became impossible to let the properties at all. The prospect of one’s property being in negative equity became a reality for many in the sector. Selling properties at a loss became a most unattractive option. People held on to their ‘Buy to Let’ properties for too long hoping that the housing market would improve but it simply got worse. Eventually many people found that they were insolvent and that their disposable income was insufficient to bridge the gap between their mortgage payments and their rental income. Thus their mortgage payments began to fall into arrears and they began to look around for solutions to their financial difficulties.

Given that selling the properties would lead to shortfalls debtors found that their options were limited to petitioning for Bankruptcy (BCY) or entering into an Individual Voluntary Arrangement (IVA). Choosing the best option to go with very much depends on the individual’s circumstances. The main factor to be considered in an IVA is the attitude of the creditors and in BCY the approach of the Official Receiver and/or of the Trustee.

Buy to Let in an IVA

In proposing an IVA, the ‘Buy to Let’ property has to be considered from two perspectives – the net cost to the debtor of retaining the property and the equity therein. If the debtor has several or indeed many such properties, then each property usually has to be considered separately and on its own merits, so to speak.

If a property is ‘cost neutral’ i.e. the rental income is wholly consumed by the mortgage payments (plus any other valid associated costs such as insurance or maintenance) with no significant surplus or deficit arising then creditors will only be interested in whether there is any equity available in and recoverable from the property. Unsecured creditors will not force the debtor to sell a property which is in negative equity since any shortfall arising would then be introduced into the IVA and would have the effect of reducing the dividend for all creditors. If on the other hand the property has a significant amount of positive equity then creditors will expect all such equity or a high percentage of it to be introduced into the IVA. Thus the property in question may have to be sold or the equity addressed by some other means such as the contribution of third party funds or remortgage.

If the property is ‘cost positive’ and generates significant net income i.e. the rental income exceeds the mortgage payments (plus any other valid associated costs such as insurance or maintenance), then creditors will expect any such surplus income to be contributed to the IVA over the full term of the IVA. If the property is in negative equity, it is not in the interests of creditors that it be sold. If there is significant equity in the property then creditors will expect all or a high percentage of such equity to be realized by sale or remortgage before the end of the term of the IVA, usually in the fourth or fifth year.

Finally if the property is ‘cost negative’ i.e. the rental income is significantly lower than the mortgage payments (plus any other valid associated costs such as insurance or maintenance), then creditors might require the debtor to sell the property. Following such a sale, the savings made from eliminating the ‘cost negative’ factor would allow monthly contributions to the IVA to be increased. If the property was in positive equity, any equity realized would be contributed to the IVA. Obviously, if the property was in substantial negative equity, the shortfall following its sale would be claimed as an unsecured debt of the arrangement. This could depress the dividend to such an extent that it would be in the interests of the unsecured creditors to allow the debtor to retain the property, not withstanding the fact that its retention would be ‘cost negative’. However, once the property is no longer in negative equity, creditors might require that it be sold and the savings introduced into the IVA.

Buy to Let in Bankruptcy

The bankrupt’s estate vests in the trustee immediately on his appointment taking effect or in the case of the official receiver, on his becoming trustee. The trustee can disclaim any onerous property and any property in significant negative equity would be regarded as onerous property.

Property with equity of up to £1,000 – deemed de minimis – can usually be bought back from the trustee for a nominal sum. It is not uncommon for the family of a bankrupt to buy back such a property on payment of £1 plus the official receiver’s costs of £211.

If the equity in the property is in the range of £1,000 to £5,000 then the trustee may seek to register a charge on the property rather than trying to realize this equity by having the property sold, with the risk that the sales price might not reach market value and that the equity realized might not cover the cost of sales.

If the equity in the property exceeds £5,000, the trustee may seek to sell the property and to realize the equity for the benefit of creditors and to pay the costs of bankruptcy. The bankruptcy laws deal in great detail with the rights and duties of the trustee and the bankrupt and the rights of other parties such as the bankrupt’s family and of creditors.

Where a bankrupt owns one or more ‘Buy to Let’ properties it appears that there has been a relatively recent change in the attitude of some trustees to the treatment of such properties. Historically where there was little or no equity in such a property, trustees allowed the bankrupt’s family to ‘buy back’ the property and allowed the bankrupt to manage the letting of the property and the servicing of the mortgage. Any surplus income thus generated would constitute part of the bankrupt’s disposable income and be subject to an income payments order. Thus the trustee would receive payments from the bankrupt for up to three years.

More recently, it appears that some trustees seek to seize control of such ‘Buy to Let’ properties and to assume all responsibility for them: receive all rental income; pay the mortgage and all associated insurance & maintenance costs; deal with all letting and tenant issues and take all the day to day decisions relating to the properties. Should the properties go into significant positive equity in the first three years of the bankruptcy, the trustee would also be in a position to realize the equity prior to the property re-vesting in the bankrupt debtor. The motivation for this change in approach by trustees is unclear unless they expect to improve the returns for creditors by taking such action. Should you become bankrupt and the trustee is intending to seize control of your ‘Buy to Let’ properties, you should seek to obtain legal advice on this matter.